Investing: The Importance of Starting Early – You Too Can Become a Millionaire and Here Are 3 Easy Steps!

The great Albert Einstein once said: “Compound interest is the eighth wonder of the world.” He who understands it, earns it; he who doesn’t, pays it.

If you are reading this article, you should ask yourself: “What end of the spectrum am I on?” Are you investing in assets and earning interest and income, or are you still in heavy consumer debt that is preventing you from building wealth? I am here to explain the importance of investing early, and outline 3 steps that you can take to develop a wealth building plan.

First, let me tell you a quick story. Just a few months ago a woman at my church who knew I was in Accounting/Finance stopped me after communion and said, “Ryan, I am 58 years old and I am a millionaire, but I have never made more than $43,000 a year!” She went further to tell her story and it seemed to have all the hurdles possible. She went through a tough divorce when her kids were teenagers, she was battling a blood disease, and she lost her parents when she was young. I had asked her how was she able to stay disciplined enough to be able to be a millionaire at 58 through all of this controversy! She attributed it to her mother’s wisdom of getting on a budget, and investing 15% of her income each year.

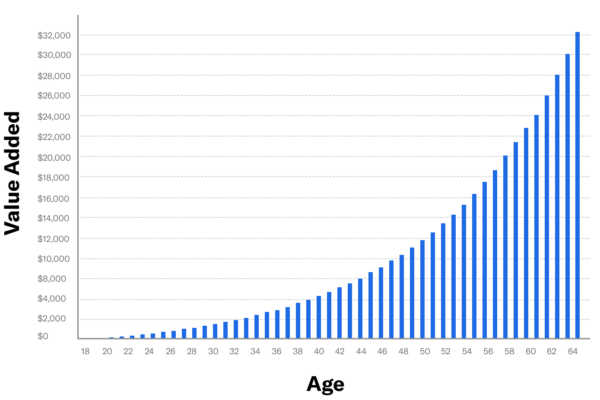

Now I am not saying it will be easy for everyone. Some of you reading this article may face adversity and hardships, but I want you all to know that you are closer to retiring as a millionaire than you think – all because the power of compound interest! Below I will show you an example.

These are the variables, assuming the person:

- is 25 or 35 years old when they START investing

- invests until they are 65

- either makes the average or median salary per SSA

- never RECEIVES a raise in their career

- lives in a state with a 5% tax rate

A 25 year old person who invests $160 a month from age 25-65 will have roughly $1,000,000 at age 65, assuming a 10% rate of return which has been the 90 year average of the S&P500. Per the Social Security Administration, the average salary was $51,916 & the median salary being $34,248. These are very different numbers but we’ll just go with it. I decided to factor in federal, state and payroll taxes.

| Average | Median | |

| Salary | $51,916 | $34,248 |

| Federal Income Tax | $4,417 | $2,406 |

| FICA Taxes | $3,972 | $2,620 |

| State Taxes (5%) | $1,968 | $1,085 |

| After Tax Take Home Pay | $41,560 | $28,137 |

| Monthly Take Home Pay | $3,463 | $2,345 |

| $160 is what percentage of take home pay? | 5% | 7% |

To summarize, a 25 year old person making $51,916 a year and a 25 year old person making $34,248 a year can both retire millionaires. The difference is that the latter has to invest a larger percentage of their take home pay into retirement. This is assuming both individuals make the same amount of money every single year (highly unlikely) and that they don’t invest more than 5/7%.

Now, a 35 year old who is just starting to invest would have to invest 3x the monthly amount that the 25 year old does. Since they start 10 years later, they have to invest $480 a month instead of $160 a month in order to retire a millionaire at 65.

The key takeaway from this should be that you too can become a millionaire. START INVESTING EARLY!

I promised you 3 habits that will help accelerate this process.

- Get on a written budget and track your income/expenses. Most Americans are not on a written budget and do not see how much wealth they can build. Once you create a budget you will be able to analyze where your money is going and see exactly what you are spending it on.

- Automate your Finances. Set up your retirement accounts to automatically draw from your checking account (you should have it set up to take that certain % of your income) Automating your finances will save you time in the long run and allows you to focus on more important concepts.

- Dollar-Cost-Average. Google it! Dollar Cost Averaging (DCA) ensures that we aren’t timing the market or that we could take a loss from a market correction. DCA removes emotion from the equation, as you aren’t constantly looking at the stock market. It doesn’t matter if it’s green or red, you just do the same thing every single month. Trust me – it works!

To hone in on numbers 2&3, a study from Fidelity found that, from 2003-2013, the best performing accounts were from investors who were dead… What about the second-best performing accounts? Investors who had forgotten they had an account… This means that you should automate your finances, DCA, and set it and forget about it for a while!

If you would like to reach out to me I am on Instagram/Twitter @LearnLikeaCPA

Sincerely,

Ryan